HR MARKET REVIEW

Sydney HR Market – 2025 Recap & 2026 Outlook

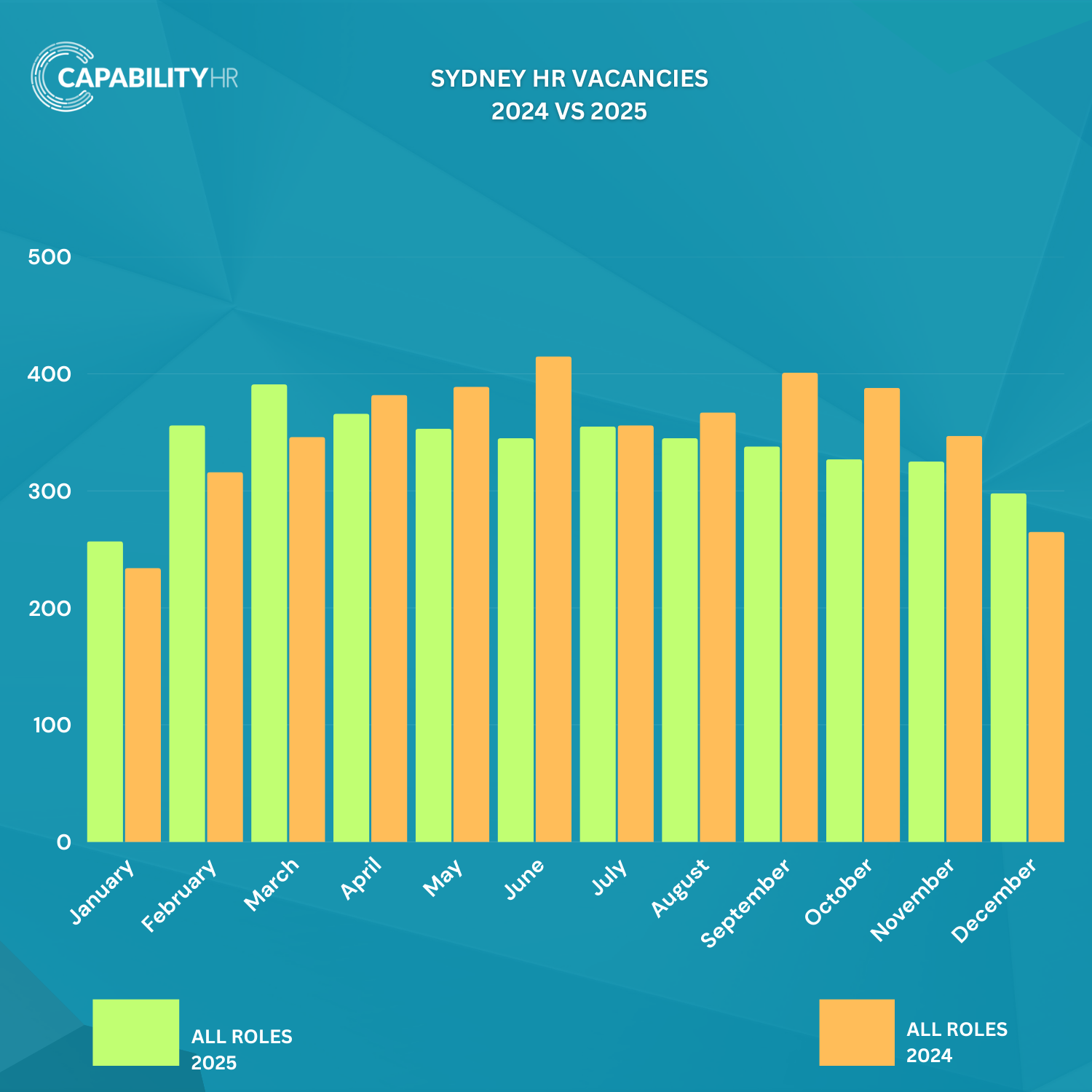

The Sydney HR market in 2025 showed a clear pivot from the mid-year growth of 2024 to a “front-loaded” cycle. Hiring demand surged early, peaking in March (391 roles), and ended the year stronger than 2024 with December vacancies up 12.4%. Yet overall volumes were slightly weaker than 2024, reflecting a cautious, replacement-driven market rather than expansion.

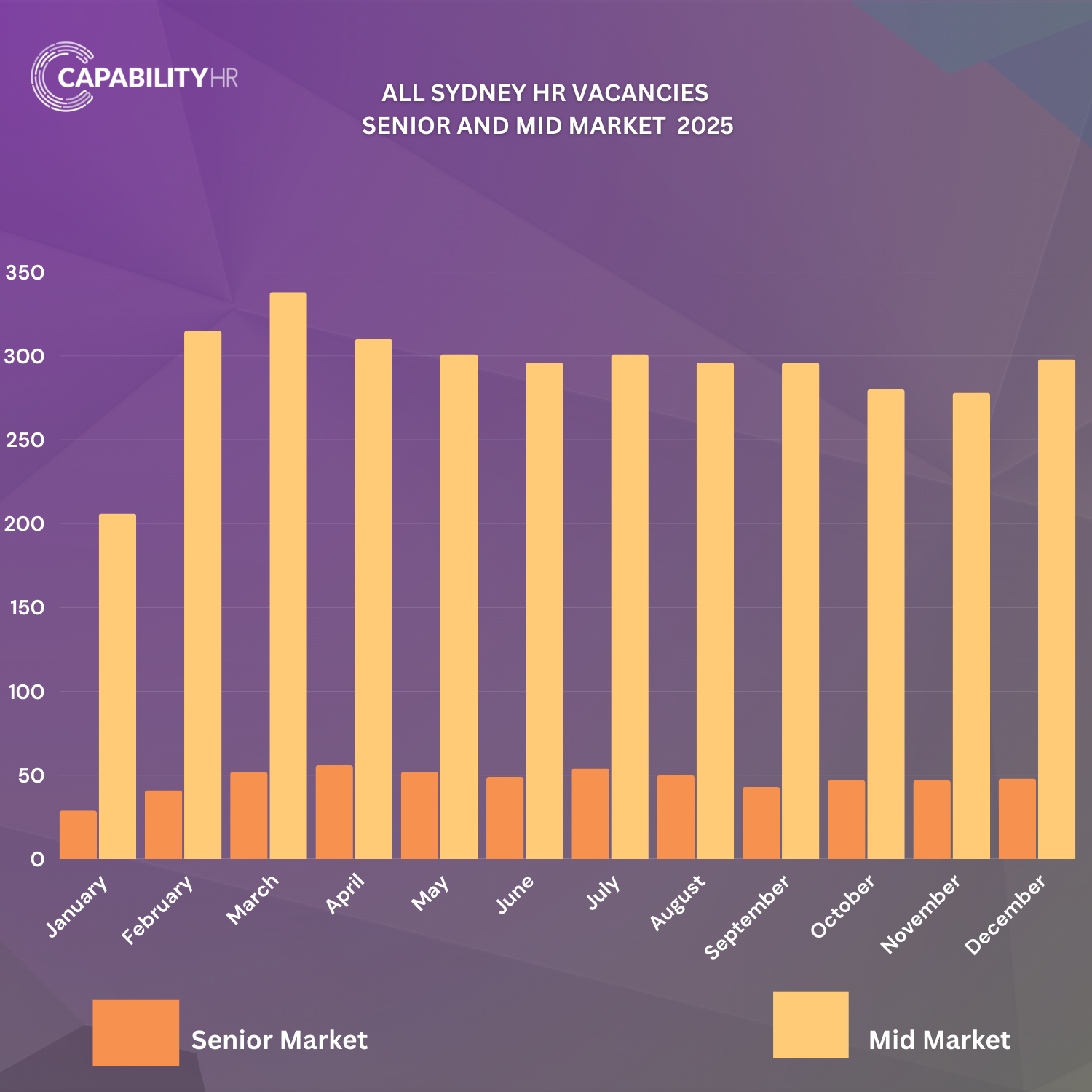

A defining feature was the two-speed dynamic:

Mid-Market roles ($120K to $200K) reacted sharply to budget cycles, spiking in February/March but cooling later in the year. Overall numbers at this level have had a reasonable demand throughout the year.

Senior hires ($200K+) followed a steadier trend, peaking in April/May and remaining resilient through Q4, with boards deliberately securing leadership talent before 2026. It was another disappoint year in terms of volume of senior roles, with candidates supply always exceeding available roles.

Similarly, the perm vs. temp split highlight the permanent driven market in Sydney, with temporary roles weaker. However, February saw a notable temp surge (22% of vacancies) as firms bridged gaps before permanent hires. But permanent roles quickly regained dominance, averaging ~87% of the market, underscoring long-term structural stability.

Sector demand was diverse: Technology and Industrial led (31% combined), while Finance and Healthcare provided stability.

2026 Outlook: The market ends with confidence. HR teams are leaner than at any point in two years, following restructures and unfilled departures. This creates cautious optimism: firms are expected to move quickly in January, balancing agility with structural headcount. For candidates, the early months will be highly active; for hiring managers, the lesson is clear—timing your search around these cycles is critical.

Follow our page by clicking the link below for more HR Market Insights!